马来西亚电子发票新规答疑🔥 这两点超关键!

Recently, many of you have been confused by Malaysia’s new e – invoice regulations. Today, we’ve sorted out two super – important FAQs to help you understand the rules in a second👇

最近好多小伙伴被马来西亚电子发票新规搞懵,今天整理超重要的两个 FAQ,帮你秒懂规则👇

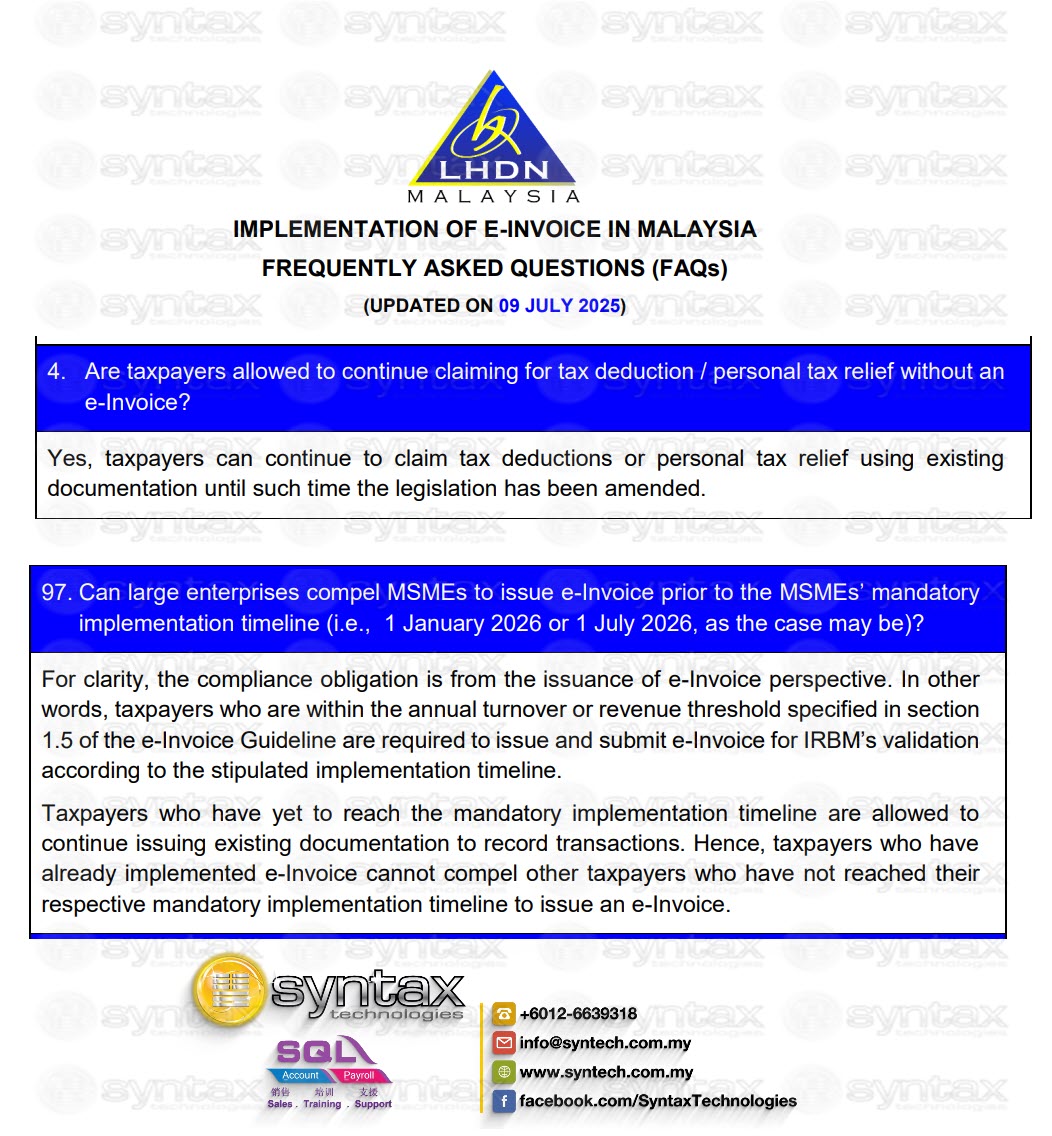

👉 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧 𝟒: 𝐂𝐚𝐧 𝐭𝐚𝐱𝐩𝐚𝐲𝐞𝐫𝐬 𝐬𝐭𝐢𝐥𝐥 𝐜𝐥𝐚𝐢𝐦 𝐭𝐚𝐱 𝐝𝐞𝐝𝐮𝐜𝐭𝐢𝐨𝐧/𝐩𝐞𝐫𝐬𝐨𝐧𝐚𝐥 𝐭𝐚𝐱 𝐫𝐞𝐥𝐢𝐞𝐟 𝐰𝐢𝐭𝐡𝐨𝐮𝐭 𝐚𝐧 𝐞 – 𝐈𝐧𝐯𝐨𝐢𝐜𝐞❓

👉 问题 4:没有电子发票,还能申请税务减免 / 个人税收减免吗?

The answer is yes! As long as the existing laws haven’t been amended, taxpayers can still use traditional documents (such as receipts, ordinary invoices, etc.) to apply for tax deductions and personal tax relief. However, note that this is a transitional phase situation. If subsequent policies are adjusted, you need to follow the changes~

答案是可以! 只要现有法律没修改,纳税人依旧能用传统凭证(像收据、普通发票这些)申请税务抵扣、个人税收减免。不过要注意,这是过渡阶段的情况,后续政策要是调整,得跟着变~

👉 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧 𝟗𝟕: 𝐂𝐚𝐧 𝐥𝐚𝐫𝐠𝐞 𝐞𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞𝐬 𝐜𝐨𝐦𝐩𝐞𝐥 𝐌𝐒𝐌𝐄𝐬 𝐭𝐨 𝐢𝐬𝐬𝐮𝐞 𝐞 – 𝐈𝐧𝐯𝐨𝐢𝐜𝐞𝐬 𝐛𝐞𝐟𝐨𝐫𝐞 𝐌𝐒𝐌𝐄𝐬❜ 𝐦𝐚𝐧𝐝𝐚𝐭𝐨𝐫𝐲 𝐢𝐦𝐩𝐥𝐞𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐭𝐢𝐦𝐞𝐥𝐢𝐧𝐞 (𝐢.𝐞., 𝟏 𝐉𝐚𝐧𝐮𝐚𝐫𝐲 𝟐𝟎𝟐𝟔 𝐨𝐫 𝟏 𝐉𝐮𝐥𝐲 𝟐𝟎𝟐𝟔, 𝐚𝐬 𝐭𝐡𝐞 𝐜𝐚𝐬𝐞 𝐦𝐚𝐲 𝐛𝐞)❓

👉 问题 97:大企业能强制中小企业提前开电子发票吗?

No! The compliance obligation of e – invoices is based on “the enterprise’s own mandatory implementation time”. In simple terms:

For MSMEs that haven’t reached their mandatory implementation time, they can continue to use existing documents to record transactions and don’t need to issue e – invoices.

Large enterprises that have already implemented e – invoices cannot force enterprises that haven’t met the requirements to issue e – invoices in advance. Everyone follows their own timeline!

不行! 电子发票的合规义务,是按 “企业自身强制推行时间” 来的。简单说:

没到强制推行时间的中小企业,可以继续用现有凭证记录交易,不用开电子发票。

已经实施电子发票的大企业,不能强迫未达标企业提前开电子发票 ,大家按自己的时间线来!

💡 Want to know more about the practical details of e – invoices? Remember to stay tuned for our subsequent updates! Key Notes on E – Invoices by Bryan Cheong

💡想了解更多电子发票实操细节,记得蹲我们后续更新!Bryan Cheong电子发票重点小笔记

𝐁𝐫𝐲𝐚𝐧 𝐂𝐡𝐞𝐨𝐧𝐠 𝐄-𝐈𝐧𝐯𝐨𝐢𝐜𝐞 𝐆𝐮𝐢𝐝𝐞

![]() Syntax Technologies Sdn Bhd

Syntax Technologies Sdn Bhd

SQL Accounting Software & SQL Payroll Software

Sales . Training . Support

📞 012 – 663 9318

📧 info@syntech.com.my

Stay connected with us on various platforms:

![]() :https://www.facebook.com/SyntaxTechnologies

:https://www.facebook.com/SyntaxTechnologies

![]() :https://www.tiktok.com/@syntaxtechnologies

:https://www.tiktok.com/@syntaxtechnologies

![]() :https://www.youtube.com/@syntaxtechnologies

:https://www.youtube.com/@syntaxtechnologies

![]() :https://www.youtube.com/@SQLAccEinvoiceForum

:https://www.youtube.com/@SQLAccEinvoiceForum

![]() :https://www.linkedin.com/in/bryancheongcheesan/

:https://www.linkedin.com/in/bryancheongcheesan/

![]() :https://syntech.com.my/xiaohongshu

:https://syntech.com.my/xiaohongshu

If you have any uncertainties or questions, you are cordially invited to join our discussion groups.

- Malaysia e-Invoice Discussion Forum

:https://www.facebook.com/groups/einvoiceforum

:https://www.facebook.com/groups/einvoiceforum - 马来西亚电子发票 (e-Invoicing)- 中文交流群组

:https://www.facebook.com/groups/einvoicechineseforum

:https://www.facebook.com/groups/einvoicechineseforum - SQL Accounting Software | SQL Payroll Software | SQL e-Invoice Discussion Forum

:https://www.facebook.com/groups/sqleinvoiceforum

:https://www.facebook.com/groups/sqleinvoiceforum