10 Steps To Setup Commission Scheme For Your Company

10 Steps To Setup Commission Scheme For Your Company 01) Commission is based on Sales, Collection, Profit Margin or Combination? 02) Different Stock Group Different

10 Steps To Setup Commission Scheme For Your Company 01) Commission is based on Sales, Collection, Profit Margin or Combination? 02) Different Stock Group Different

5 Ways to file a complaint to Labour Office against Your Boss including via a Mobile Apps

1)Direct Walk in to Nearest Labour Office

2)Call to Labour Office

3)Email

4)Fill Up Ministry of Human Resource Online Complain Form at SISPAA

5)WFW(Working For Workers) Mobile Apps

CP38 is an additional tax deduction issued by LHDN. CP38 requires the employer to make additional deductions in the form of monthly instalments from their employees’ salaries.

This tax deduction is calculated based on the employees monthly taxable income. This income tax deduction based on the Tax Deduction Chart that is issued by the Internal Revenue Board Of Malaysia (IRBM).

Employment Letter /Offer Letter need to base on Employment Act and Employment Regulation. Do you want to get a Ministry of Human Resource Reviewed Employment Letter /Offer Letter Template? You may use it as a base to create your own or compare with what you have now and amend accordingly. Let’s check out how to get this template for FREE.

Bryan Cheong will guide you step by step on how to submit and pay your personal income tax or Borang BE in MyTax Portal. Employees will receive EA form latest by end of February every year, and based on EA Form and other details, employees need to furnish personal tax submissions before end of April every year or 15 May if doing e-Filling. Check it out.

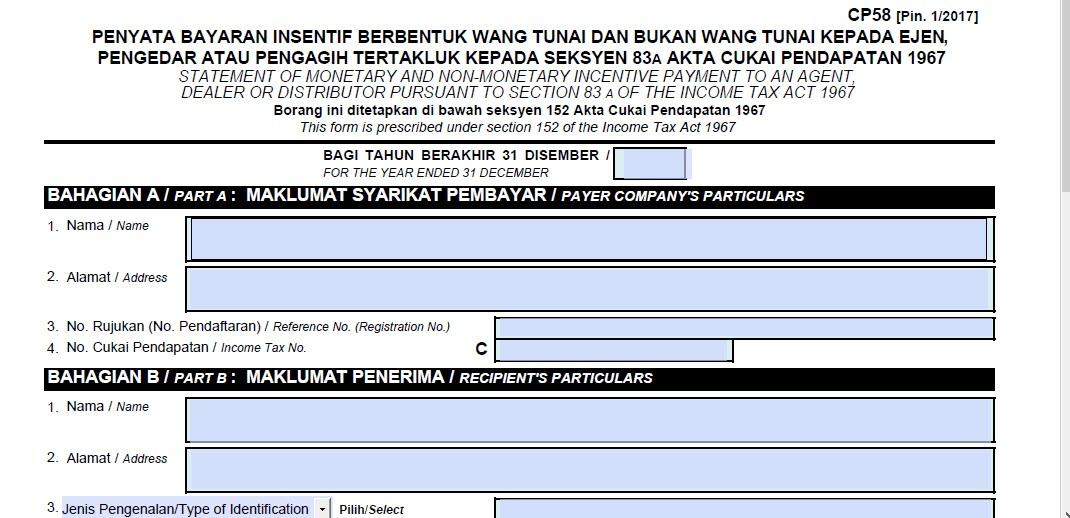

CP 58 form is not a tax filing form. It is an income statement that shows the income of incentives, allowances, bonuses, etc. for agents, dealers and distributors, similar to the EA form received by employee. CP58 is Compulsory given to them before 31 March next year if THE amount more than RM5000 or requested by them even amount less than RM5000 in a calendar year.

Employment Act – Annual Leave & Sick Leave Entitlement

Complete Guide on Submission of CP204 via MyTax Portal

SQL Accounting Software Mobile Approval now streamline your workflow and easily approve transactions through mobile.

SQL Accounting Software Branch Control Customization is done to prevent branch user from selecting Customer, Project or Location info that is not relevant to them.

Get latest Offers and Updates on Our SQL Accounting Live Seminar and Training

Incorporated in 2004, Syntax Technologies Sdn Bhd is top SQL Accounting Software & SQL Payroll Software Service Provider with more than 20 years experience, focused on SQL Software, SST, eInvoice Consultancy, Sales, Training and Support.